During times of economic uncertainty, gold has historically been seen as a safe-haven asset such as Gold and a store of wealth. Its price swings frequently pique the interest of traders and investors who keep a careful eye on market circumstances.

Traders are currently thinking that gold is entering a phase of consolidation, implying a short respite in big price fluctuations. This article delves into the notion of consolidation, the elements that contribute to this expectation, and the ramifications for gold traders.

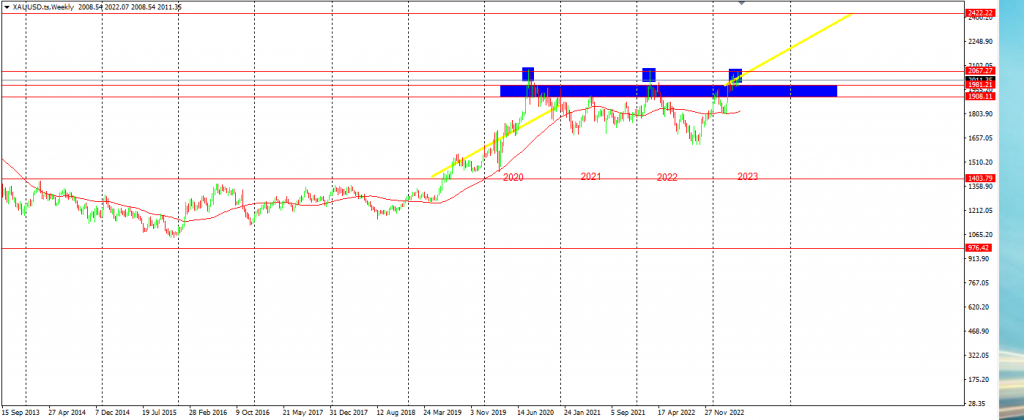

The XAUUSD Performance

Currently trending above 1981.21, slightly higher than previous rejection zones in 2020 & 2022. Technically speaking on a long-term basis, aiming for about 2422.22 should we break 2067.27. This move could possibly take up to 2 years to complete with a smooth trending market, but volatility can create another scenario.

Short-term traders should watch the support level of 1981.21 for short positions if any fundamental drivers affect the current upward momentum. The price could drop down to 1908.11. Anything lower than 1908.11 would mean that Gold is now back into 2020 & 2021 consolidation.

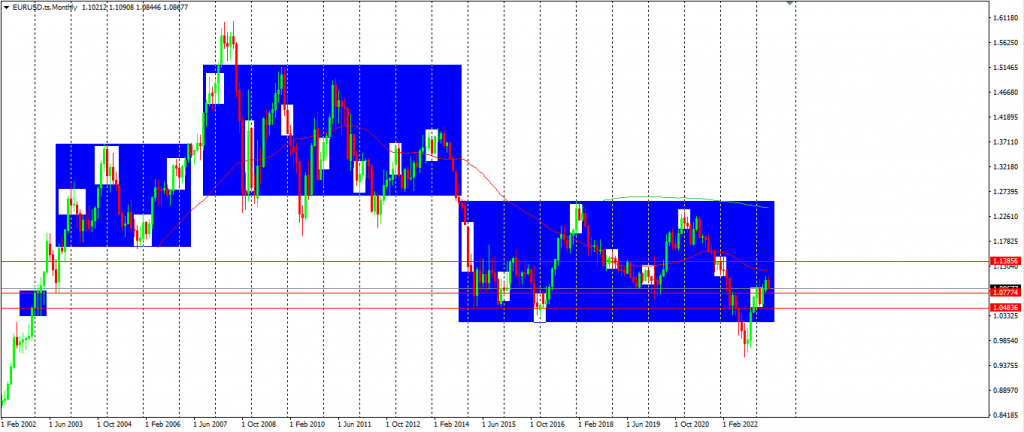

The EURUSD Performance

Currently sitting in the same support area as 2002 before it pushed up significantly for a few years. EURUSD correlates with the EURO Index, the price action of both is above the 200-day moving average. The current downtrend trend still has no clear direction for long-term buyers as the resistance to structure 1.19932 must be broken before we could see strong buyers coming in.

Level 1.13856 would be where the price could set up a correction back down to previous support areas. Should the US economy curb inflation and create more opportunities for consumption, the dollar could regain some strength which could push the price back to support area 1.04836, short term traders should monitor a possible short for day trading purposes.

Final thoughts on today’s analysis

While traders expect gold to consolidate, it's vital to remember that financial markets are fundamentally volatile. The aforementioned criteria are only speculative indications, and unforeseen developments can swiftly change market dynamics. To make educated judgements, traders should continue to regularly watch economic statistics, central bank policies, and technical patterns. Consolidation may bring both obstacles and possibilities, so traders must change their methods while putting risk management at the forefront of their strategy.