The recent Federal Open Market Committee (FOMC) meeting has delivered a robust boost to the USDJPY currency pair while putting downward pressure on gold prices. The FOMC's policy decisions and accompanying statements have provided strength to the USDJPY exchange rate, showcasing the market's response to the central bank's actions.

Simultaneously, the gold market has witnessed a decline as investors adjust their positions based on the FOMC's outlook. This article explores the impact of the FOMC's actions on USD/JPY and gold prices, highlighting the key factors driving these market movements.

The XAUUSD Performance

The Federal Reserve has kept the rates unchanged, the result left Gold moving further down in the range back to the price point of 1933.60. Traders are now betting on two more hikes of 25bps over the remaining four meetings this year.

A daily close below 1933.60 could be a sustained move towards the initial target at price point 1908. Traders should be monitoring the DXY very closely as well as major pairs that correlate positively with the US Dollar Index for more probability of price action.

The USDJPY Performance

The Fed kept its benchmark interest rate within a range of 5.00% to 5.25% at its June policy meeting, saying that holding rates steady allows it to assess additional information and its implications for monetary policy. The aftermath of the FOMC meeting leaving rates unchanged has pushed strength into the US Dollar in this pair.

It has now broken above 140.222 for the second time creating another Higher High. A close of a daily candle above the mentioned area comes as a signal of sustained strength for the US Dollar.

The target is still set at 144.449, traders should monitor the price for retracements on smaller time frames if they would like to enter this trade, the H1 frame becomes a reference point for a possible correction if any.

Read More: Traditional Trading to EA: What’s Next for the FX/CFD?

The NZDJPY Performance

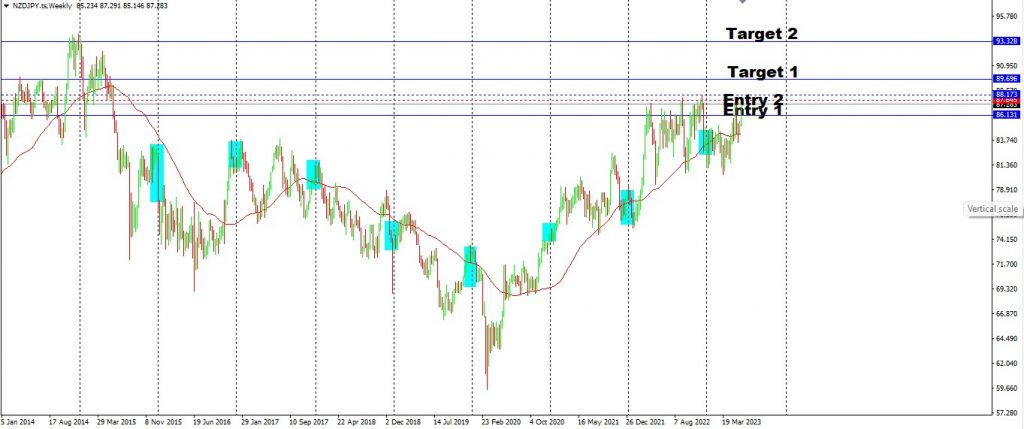

Price is currently trending above 6 annual pivot points, approaching strong valid resistance at price point 87.645. New Zealand’s economy advanced by 2.2 per cent from a year earlier in the first quarter of 2023, following an upwardly revised 2.3 per cent growth in the previous period and missing market estimates of a 2.6 per cent rise.

Furthermore, with the Technical and Fundamentals not having a positive correlation, traders should wait for further price action above 87.645 and even consider a close above 88.173 Targets analysed at point 1 are at price point 89.696. Target 2 sets at price point 93.328.

Final Thoughts On Today’s Analysis

The FOMC's recent decision to raise interest rates and its optimistic outlook on the US economy has bolstered the USD/JPY exchange rate while exerting downward pressure on gold prices. Investors have responded by favouring the US dollar, attracted by higher yields and the perception of a strong economic recovery.

As a result, the USDJPY pair has appreciated, reflecting the market's confidence in the US dollar. Conversely, gold prices have declined as the stronger dollar made the precious metal relatively more expensive and reduced its appeal. The FOMC's actions and statements have set the stage for ongoing market movements, with future developments likely to shape the trajectory of USDJPY and gold prices.