Federal Chair J Powell is poised to provide valuable insight into the future direction of interest rates, as market participants eagerly await his upcoming remarks. With the Canadian dollar (CAD) holding steadfast at a key resistance level, investors are left wondering whether a correction is imminent or if the currency is poised to push even higher.

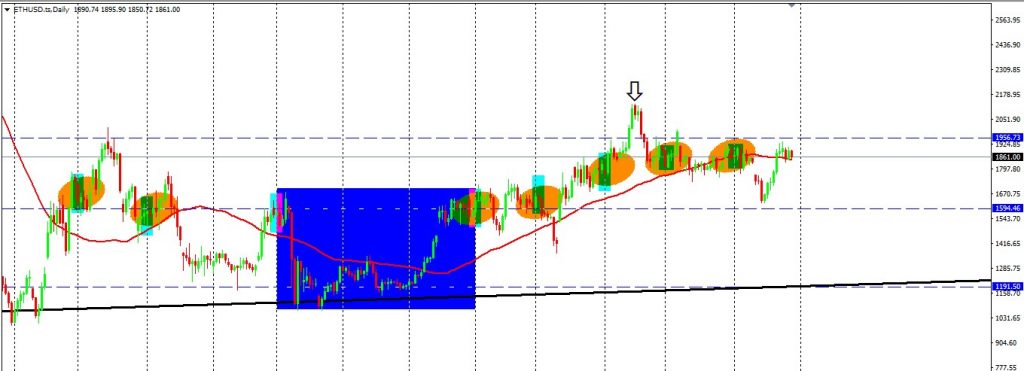

The ETHUSD Performance

Currently trending above 2 monthly pivot points and consolidating a daily on a daily frame between several key levels. Price has had 2 highs already on the higher time frames at points 1956.73 and 2108.62. A break above both these highs would be an entry for traders to take it up to target 3061.71.

However, entries will be discussed the closer we get to that level of breakout. It is trending above the 52-week average giving us an indication that the dominating movement at this point is bullish. Ethereum and Bitcoin have similar correlations in terms of volatility in percentage. Both fluctuate at similar levels between 12-14%.

The AUDUSD Performance

This pair is back in the previous range it broke out from, it was that we would not touch or look at it again unless it pushes back into the downward channel. It has closed beneath the key range level at 0.67262 with a weekly candle.

We look forward to some dollar strength coming in after the Fed Speeches to push prices in favour of the dollar below the price point of 0.65790. We can look to re-enter the trade after this level is broken with a momentum candle is below 0.65790.

The CADJPY Performance

The target is at 106.155. Price has been trending up as per the analysis from inception and has now reached the target of 108.844 successfully. Traders now need to look to the monthly candle to look for price action formations. The next week (5 days) will give us more data to work with to begin analysing a path of direction.

Read More: JPY Is Seeing Less Strength, Major Currencies Advance

Final Thoughts On Today’s Analysis

In conclusion, all eyes are on Fed Chair Jerome Powell as he prepares to offer crucial guidance on the future direction of interest rates. His remarks will play a pivotal role in shaping market expectations and influencing the trajectory of the Canadian dollar. As the CAD holds at a resistance level, investors are eager to decipher whether a correction or further upward movement is in store. However, it is essential to consider a holistic view of the market, incorporating various factors that impact currency valuations.