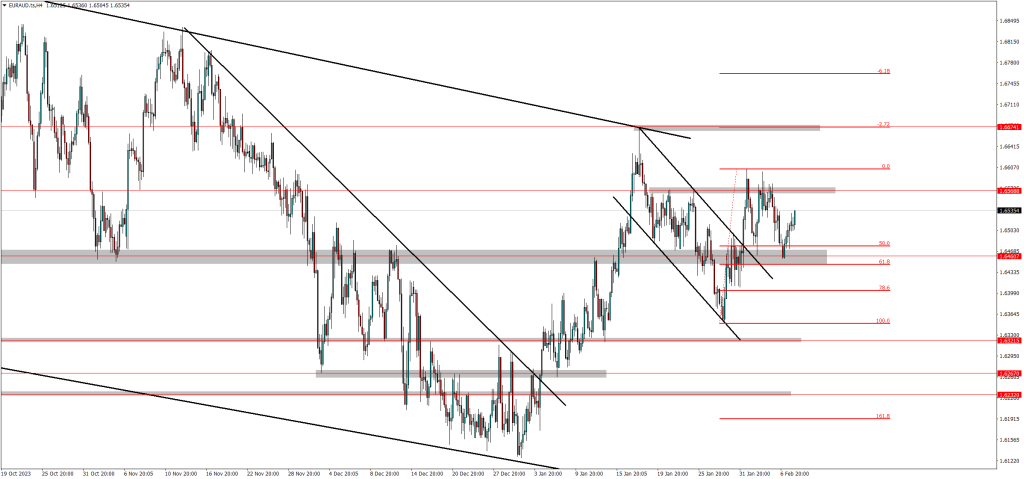

The EURAUD Performace

EURAUD is up +50 pip and completed the regular flat pattern and bounced from the 50.0 fib level as well as the support zone and moved +50 pips to the upside. This price action resumes the trend and has provided trading opportunities to the upside. Traders anticipate the market to continue trading higher and break above the previous resistance zone around 1.65688 before looking for targets.

The EURUSD Performance

EURUSD is up +20 pips and is slowly pushing up from the bottom of the channel as well as the support zone. Markets are waiting for the Unemployment claims figures as it is expected to drop to 221'000 from last week's figures of 224'000. Traders anticipate a short-term bullish wave on EURUSD and could see the market aggressively pushing higher if the figures come out negative for the USD however, the market might struggle to continue pushing higher upon positive figures.

The XAUUSD (Gold) Performance

There's uncertainty on Gold and the current price action on Gold provides uncertainty amongst traders as the market is ranging between Monday's open and close at 2039.64 and 2024.70 respectively. Traders are currently sitting on their hands and are monitoring the price action for a break either to the upside or the downside to identify the next possible leg and targets.

Final Thought On Today’s Analysis

In conclusion, while the EURAUD pair demonstrates a clear bullish continuation pattern, supported by robust technical indicators, the EURUSD pair exhibits a more cautious bullish sentiment contingent upon forthcoming economic data. Conversely, uncertainty clouds the performance of Gold, with traders awaiting a definitive breakout to ascertain the market's direction. Amidst these varying market dynamics, traders must remain vigilant, adapt their strategies accordingly, and exercise prudent risk management to navigate the evolving landscape effectively.