In today's rapidly evolving financial landscape, traditional trading strategies are no longer the only path to financial success. One of the most intriguing and accessible innovations in the world of finance is Copy Trading also known as Social Trading.

In this article, we will explore the concept of Copy Trading, its mechanics, advantages, disadvantages, and how you can get started on your journey towards potentially profitable and passive income through this revolutionary trading approach at TD Markets.

What is Copy Trading?

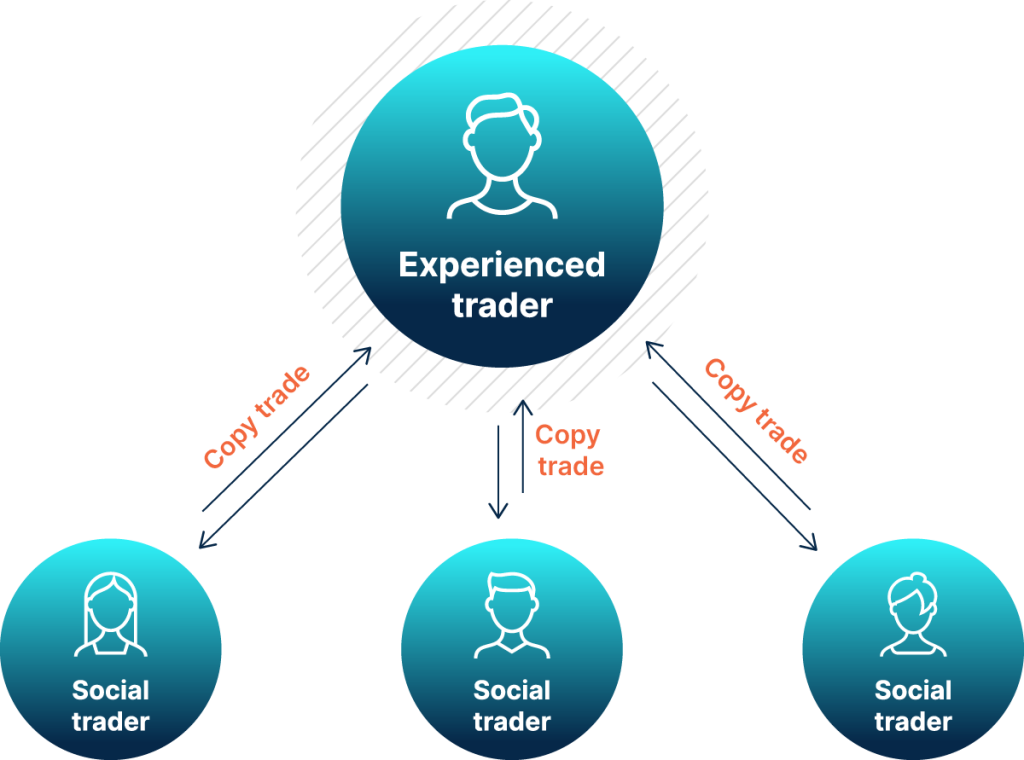

Copy Trading also known as Social Trading, at its essence, is a form of social trading. It enables investors to replicate the trading activities of experienced and successful traders, harnessing the power of technology and the wisdom of the crowd. This concept has gained immense popularity in recent years, appealing to both seasoned traders and individuals who are new to the world of finance.

How Copy Trading Works

To grasp the inner workings of Copy Trading, let's break it down step by step:

Selecting a Trader to Follow

The first crucial step in Copy Trading is choosing a trader to follow. This trader will serve as the blueprint for your trading strategy. On Copy Trading platforms, you can browse through profiles of various traders, each with their own unique trading styles, risk tolerance, and track record. This diversity allows you to find a trader whose approach aligns with your financial goals and risk appetite.

Allocating Your Capital

Once you've identified a trader you wish to follow, you need to allocate a portion of your capital to replicate their trades. The amount you allocate determines the proportion of your portfolio that will mimic the trader's actions. For example, if you allocate 10% of your capital to a trader, 10% of your portfolio will mirror their trades.

Automatic Replication

The beauty of Copy Trading lies in its automation. When the trader you're copying executes a trade, your account mirrors that action in real time. If they buy a certain stock or currency pair, your account does the same. If they sell, your portfolio follows suit. This automation ensures that you're always in sync with your chosen trader's decisions, without the need for constant manual intervention.

Monitoring and Adjusting

While Copy Trading is relatively hands-off, it doesn't mean you should set it and forget it. Regularly monitor your portfolio's performance and the trader you're following. If you notice a change in their strategy or performance that doesn't align with your goals, you can make adjustments accordingly. You can also choose to stop copying a trader at any time.

Advantages of Copy Trading

Now that we have a clear understanding of how Copy Trading operates, let's explore some of the compelling benefits it offers:

Accessibility

One of the most significant advantages of this and its accessibility. It opens the doors to the world of trading for individuals who may lack the time, expertise, or experience required for active trading. Whether you're a new or a seasoned trader, you can participate in Copy Trading and potentially benefit from the expertise of others.

Diversification

Diversification is a fundamental principle of sound investing. With Copy Trading, you can easily diversify your portfolio by copying multiple traders with different strategies. This diversification spreads your risk across various assets and markets, reducing the impact of poor performance in any single trade.

Learning Opportunity

This isn't just about copying trades; it's also an excellent learning opportunity. By observing the strategies and decisions of experienced traders, you can gain valuable insights into the world of trading. Over time, this knowledge can empower you to make more informed trading decisions on your own.

Time-Saving

Traditional trading often demands significant time and effort for research, analysis, and monitoring. This eliminates much of this burden by automating the trading process. You can engage in trading activities without the need for extensive research or constant market monitoring.

Passive Income

Perhaps the most enticing aspect of Copy Trading is its potential to generate passive income. If you select skilled and profitable traders to copy, you can earn a share of their gains without actively managing your trades. This passive income stream can provide financial security and freedom.

Risks and Challenges of Copy Trading

While Copy Trading offers numerous advantages, it's essential to be aware of the potential risks and challenges associated with this trading strategy:

Losses

Just as you can profit from copying successful traders, you can also incur losses if the traders you follow make poor decisions. While their expertise can be valuable, they are not infallible, and market conditions can change rapidly.

Over-Reliance

This can lead to over-reliance on the selected traders. If you blindly follow their actions without understanding the underlying strategies, you may not be prepared to make informed decisions when needed.

Market Volatility

Even the most experienced traders cannot predict or control market fluctuations. Your trades are still subject to market volatility, which can result in unexpected losses or gains. By deploying the social trading strategy, you will be mirroring trades from another account.

Fees and Costs

Some platforms charge fees or commissions, which can affect your overall returns. It's essential to understand the fee structure of the platform you choose and factor these costs into your trading calculations.

Risk of Trader Misconduct

In the world of finance, there is a risk of selecting traders who engage in fraudulent or unethical activities. Conduct thorough due diligence when choosing traders to copy, and use reputable and regulated Copy Trading platforms to mitigate this risk.

Copy Trading

Now that you're equipped with knowledge about Copy Trading or social trading, here are the steps to begin your Copy Trading journey:

Research and Choose a Copy Trading Platform

Start by researching and selecting a reputable Copy Trading platform that suits your needs and preferences. Look for platforms that offer a wide range of experienced traders to choose from and provide transparent fee structures.

Create and Fund Your Account

Sign up for an account with TD Markets today and fund it with the amount you're willing to. Our minimum deposit is $5 for TDM Max which has a leverage up to 1:2000. We have different product offerings that can match your trading needs.

Select a Trader to Follow

Browse through the profiles of traders available on the platform. Pay attention to their trading history, performance metrics, and risk levels. Choose a trader whose strategy aligns with your goals.

Allocate Your Capital

Determine the portion of your capital you want to allocate to Copy Trading. This decision should align with your overall trading strategy and risk tolerance. Meaning, you have complete control of your account and your funds.

Monitor and Adjust

Keep a watchful eye on your portfolio. Regularly assess the performance of the trader you're following and make adjustments if necessary. Be prepared to stop copying a trader if their performance becomes inconsistent with your goals.

Read More: Rugby World Cup: TD Markets Rally Behind Springboks

Final Thoughts On Today’s Analysis

In the ever-evolving world of finance, this stands as a beacon of innovation and accessibility. It has reshaped the landscape of trading, offering individuals of all backgrounds and expertise levels an opportunity to potentially benefit from the wisdom of experienced traders.

As we conclude this exploration of Copy Trading, it's clear that the advantages it brings, from diversification to passive income potential, are significant. Now, it's time for you to take action and embark on your copy-trading journey. Open an account today with TD Markets and discover the world of possibilities that Copy Trading can offer.