As global financial markets continue to evolve, traders are closely monitoring key currency and stock market pairs for potential trading opportunities. The current sentiment among traders suggests a bullish outlook for the AUDUSD and US30, while the USDZAR is anticipated to experience a short-term drop. This article delves into the factors driving these predictions and provides insights into the potential implications for traders.

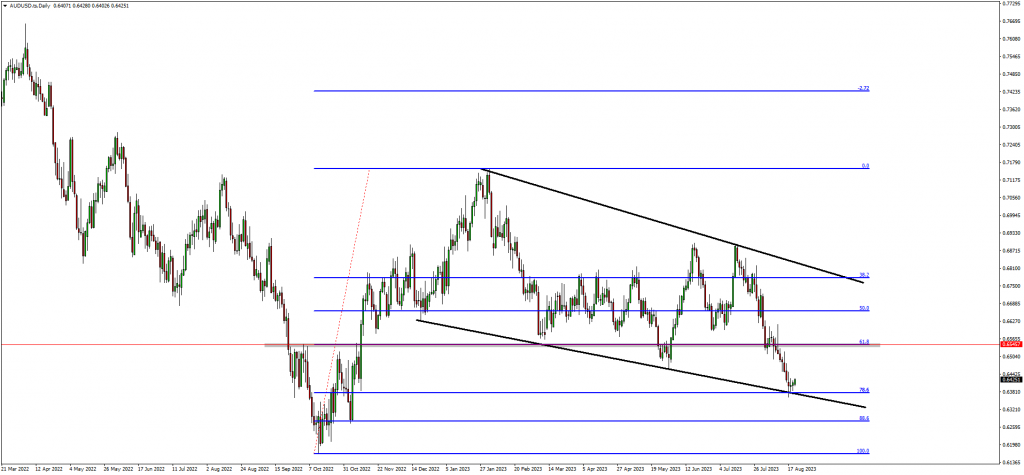

The AUDUSD Performance

AUDUSD is trading at the 78.6 fib level.

AUDUSD is trading within a descending structure. Previously the market dropped +500 pips from the top of the structure which caused the market to break below the previous support zones. This price action suggested that sellers are interested in this market. At the moment the market is trading at the bottom of the structure as well as the 78.6 fib level.

Sellers could start taking profits around this area and the market-finding support could create retracement to the upside which will be a short-term trading opportunity back to the 61.8 fib level. As such, traders will be looking at the break of structures on the lower timeframes before looking for trading opportunities.

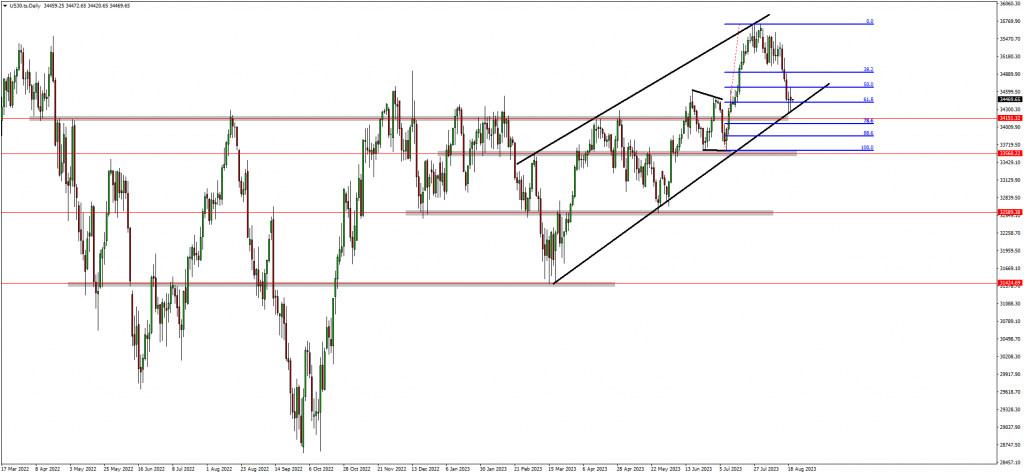

The US30 Performance

US30 is forming a retracement.

US30 is trading within a bullish market structure (bullish trend). The market created a higher high and has retraced back to the 61.8 fib level. The market created a previous structure around this 61.8 fib level which is expected to become a support zone.

This price action adds to the confluence and traders will be interested in looking for bullish trading opportunities according to this price action. As such, traders anticipate the trend to resume and are waiting for the market to reject this zone.

Read More: BTC Drops & USD Steady Ahead Of The Fed Chair Symposium

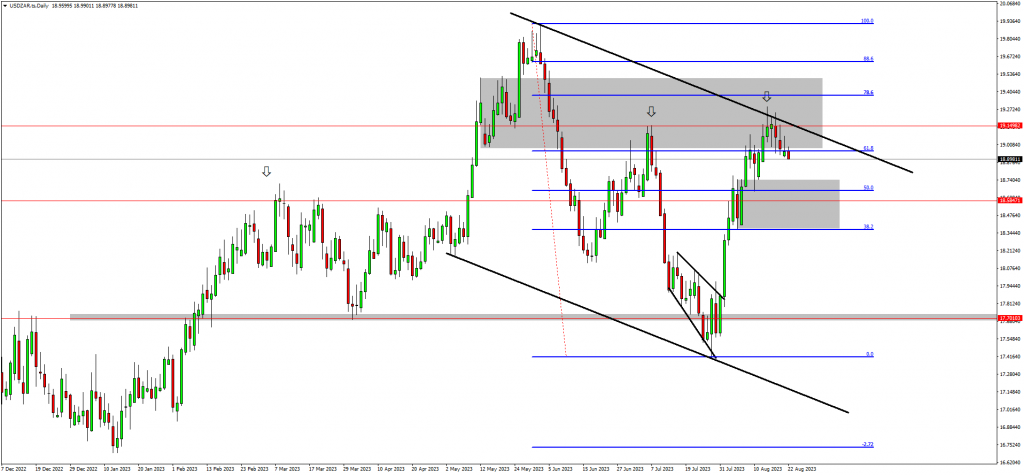

The USDZAR Performance

(UPDATE) - USDZAR is now trading below the 61.8 fib level.

USDZAR has rejected the resistance zone around 19.14982 as well as the top of the descending channel. This price action also provides possibilities of a double top which will add to the confluence. According to this price action, traders anticipate the ZAR to gain short-term strength against the USD and the market to drop to the demand zone around the 50.0 fib level. As such, traders are looking for a break of structures on the lower timeframes to confirm this outlook.

Final Thoughts On Today’s Anaylsis

In conclusion, the prevailing market sentiment suggests a bullish outlook for the AUDUSD and US30, driven by strong economic fundamentals, accommodative monetary policies, and positive investor sentiment. Conversely, the USDZAR is to face a short-term drop due improvement and confidence in the South African Rand. Subscribe to our YouTube Channel to learn more about our daily analysis and TD Markets Academy.