Traders are continuously on the lookout for prospective possibilities and threats as financial markets continue to change. Several traders are interested in the fluctuation of gold prices and stock market indexes.

They have recently become increasingly concerned about probable retracements in these markets. In this post, we will define retracements, why they are expected in gold and indices, and what traders should be aware of.

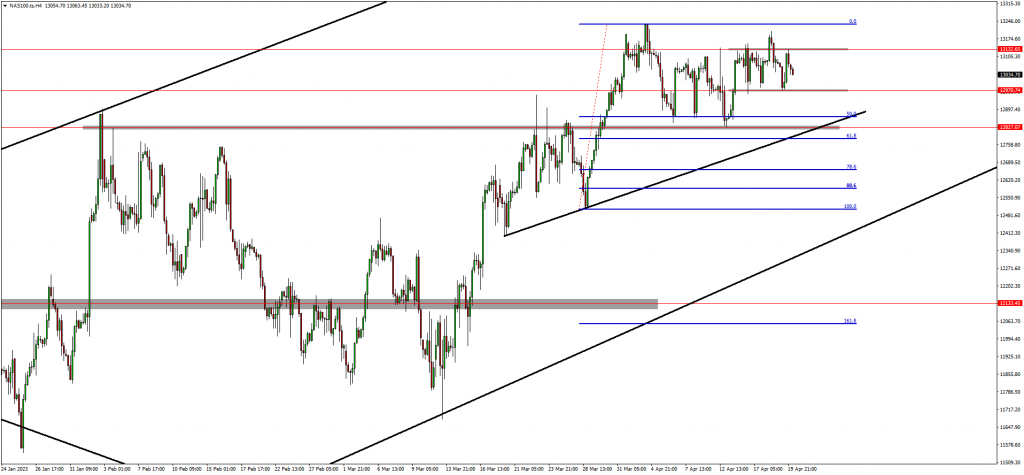

The NAS100 Performance

(UPDATE) - NAS100 is still forming a corrective structure.

NAS100 previously bounced from the 50.0 fib level and confirmed a continuation to the upside. Recently the market has struggled to continue to the upside and has formed resistance and support zones around 13132.65 and 12970.74 respectively.

This price action provides traders with the possibility of a bigger corrective structure forming which will drop prices back to the 50.0 - 61.8 fib zone before resuming the trend to the upside. As such, traders will look for trading opportunities at the completion of the corrective structure.

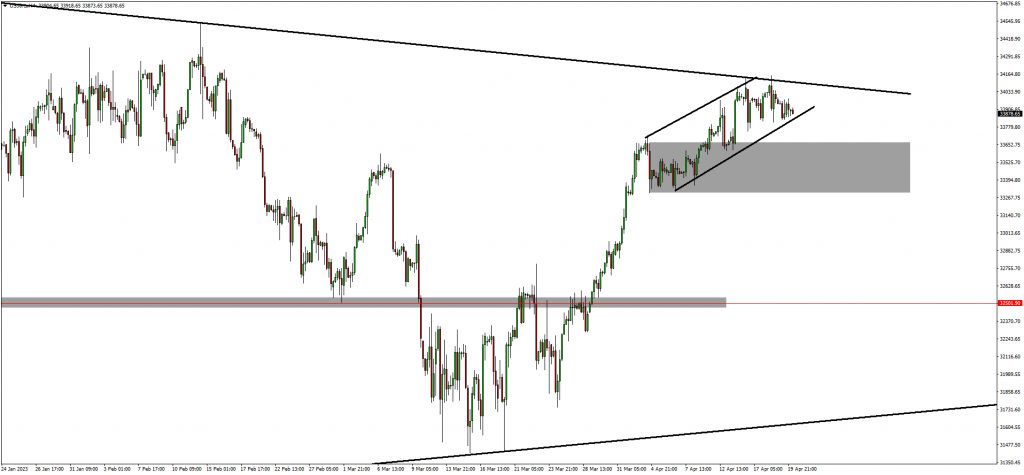

The US30 Performance

Is a retracement due on US30?

US30 recently broke above the previous structure high and continued the bullish trend. This confirmed further bullish momentum. At the moment the market is trading at the resistance trendline and is also forming an ascending structure which means a retracement could start forming.

This will then create a higher low according to market structure and develop a continuation of the trend. As such, traders will wait for a retracement before looking for continuation trading opportunities to the upside.

The XAUUSD (GOLD) Performance

(UPDATE) - GOLD is back below $2000.

GOLD broke and closed below the ascending structure as well as the resistance level around $2000. This price action has caused the market to create a lower low within an overall bullish market. According to this price action, traders anticipate GOLD to retrace and head back to the previous support zone as well as the 61.8 fib level.

Final thoughts on today’s analysis

Finally, traders expect retracements in gold and indices due to recent high advances in these markets. Retracements are seen as a regular component of market dynamics, and they might provide chances for traders to modify their trading methods.

However, while predicting retracements, it is critical to examine many elements such as technical analysis, market emotion, and fundamental reasons, as well as to be prepared for retracements that do not materialise as planned. Looking for a reliable broker? Contact us today at [email protected]