In the world of trading, there is a common expectation that retracements will occur on Indices and USDZAR at the bottom of the channel. This anticipated phenomenon is based on historical data and market analysis, indicating that price movements tend to fluctuate within a certain range.

By recognising these patterns and understanding the underlying factors driving market behaviour, traders can make informed decisions and capitalise on potential opportunities for profit. In this context, the expectation of retracements at the bottom of the channel represents a key strategy for successful trading.

The NAS100 Performance

(UPDATE) - NAS100 broke above the previous structure level.

NAS100 has developed a new ascending structure after breaking above the previous descending structure. This price action was further confirmed by the break of the resistance zone around 12889.00 which now confirms an ascending channel. Traders now anticipate a retest of the support zone which can provide short-term trading opportunities.

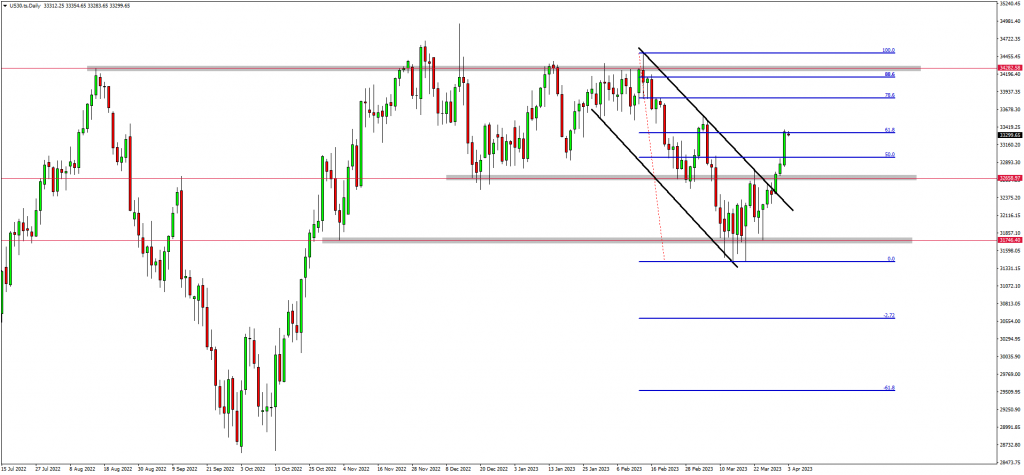

The US30 Performance

(UPDATE) - US30 aggressively broke above the resistance zone around 32650.00.

This price action forms an impulse wave to the upside, indicating a change of momentum. The market is trading at the 61.8 fib level. Traders expect a rejection from the level and a retracement back to the support for short-term trading opportunities before a continuation to the upside.

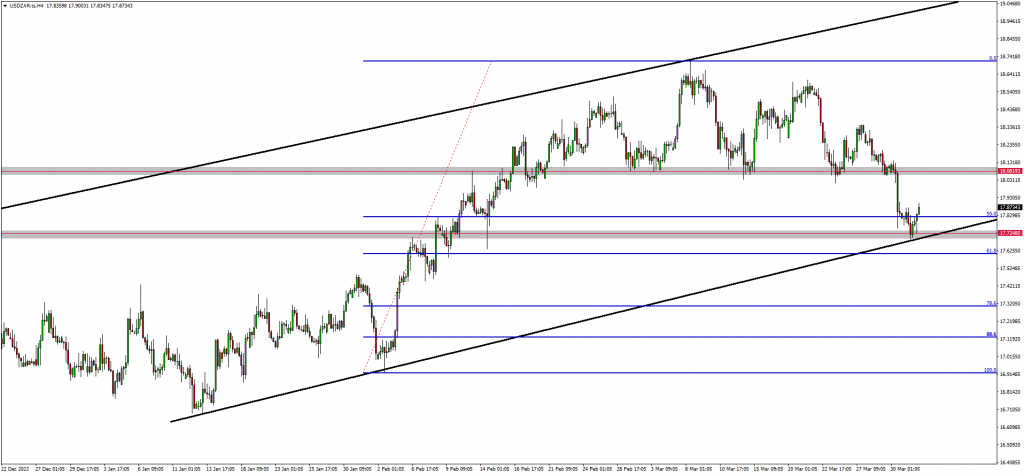

The USDZAR Performance

(UPDATE) - USDZAR testing the bottom of the channel.

USDZAR recently dropped and broke below the support zone around 18.0000. This price action confirmed the formation of the ascending channel on the D1 timeframe where the market is currently trading at the lows as well as the 50.0 fib level. Traders anticipate a rejection and a rally back to retest the broken support now turned into a resistance zone to complete a short-term trading opportunity.

Read more: What is MT4?

Final thoughts on this week’s analysis

In conclusion, the expectation of retracements on Indices and USDZAR at the bottom of the channel is a valuable insight for traders looking to optimise their trading strategies. By leveraging historical data and market analysis, traders can anticipate potential price movements and position themselves accordingly to capture profit opportunities.

However, it's important to note that trading always involves risk, and past performance does not guarantee future results. Therefore, traders must exercise caution, practice sound risk management, and continuously adapt to changing market conditions to achieve long-term success in their trading endeavours.